Hi all,

First post, thanks for having me

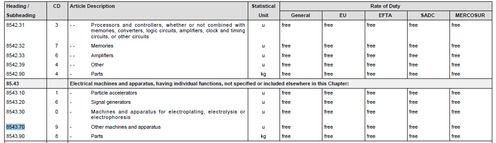

Was wondering if anyone knows what duties would be attracted by customs when importing a vaporizer?

Know the usual story re VAT etc, I'm just not sure of which HS codes/duties would apply to these devices, assuming they aren't treated as generic 'electronic devices' etc.

I've read that some here have had the experience of customs not always checking their parcels, but I'm looking more for the 'official' answer, rather than anecdotal experiences.

TIA for the help.

Cheers

First post, thanks for having me

Was wondering if anyone knows what duties would be attracted by customs when importing a vaporizer?

Know the usual story re VAT etc, I'm just not sure of which HS codes/duties would apply to these devices, assuming they aren't treated as generic 'electronic devices' etc.

I've read that some here have had the experience of customs not always checking their parcels, but I'm looking more for the 'official' answer, rather than anecdotal experiences.

TIA for the help.

Cheers