Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

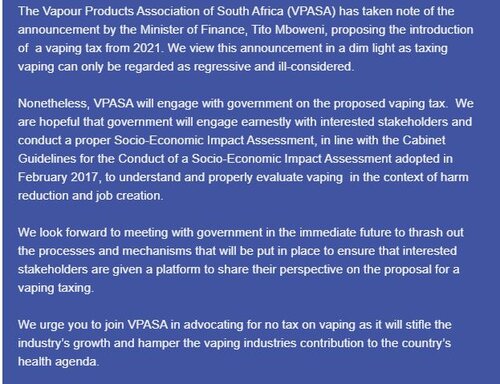

VPASA Response to proposed vaping tax 2021

- Thread starter Hooked

- Start date

-

- Tags

- vaping tax

They regard taxing vaping as "regressive and ill-considered".

Firstly, why should vaping not be taxed? Everything else is, so give me one good reason why vaping should be excluded. (Not that I would jump for joy over tax. Not at all. I'm just thinking logically.)

Secondly, if it is taxed it won't be banned! The govt. won't cut off a source of income.

Join them in "advocating for no tax on vaping"? You've got to be kidding!

Firstly, why should vaping not be taxed? Everything else is, so give me one good reason why vaping should be excluded. (Not that I would jump for joy over tax. Not at all. I'm just thinking logically.)

Secondly, if it is taxed it won't be banned! The govt. won't cut off a source of income.

Join them in "advocating for no tax on vaping"? You've got to be kidding!

They regard taxing vaping as "regressive and ill-considered".

Firstly, why should vaping not be taxed? Everything else is, so give me one good reason why vaping should be excluded. (Not that I would jump for joy over tax. Not at all. I'm just thinking logically.)

Secondly, if it is taxed it won't be banned! The govt. won't cut off a source of income.

Join them in "advocating for no tax on vaping"? You've got to be kidding!

AFAIK vaping is @ the moment taxed, just as everything else. What are they proposing is additional "sin" tax and VPASA is complaining on that.

Someone in the bussiness, please correct me if I'm wrong.

The way I have understood it is that the budget refers to taxing vaping in 2021.

It looks like it may be at 75% of the tobacco tax.

Here is the paragraph from the 2020 budget speech:

"In line with Department of Health policy, we will start taxing heated tobacco products, for example hubbly bubbly. The rate will be set at 75 per cent of the rate of cigarettes. Electronic cigarettes, or so-called vapes, will be taxed from 2021."

Its not extremely clear from the above paragraph whether the 75% is only for heated tobacco products - and that vaping will get its own level of tax in 2021 - or that vaping will also be at 75%. Nevertheless, I am assuming they mean that all these products including vaping will be at 75% of the rate on cigarettes.

I just don't know how they will calculate it - is it per ml of liquid? Per bottle? What about hardware? It really could be anything.

At least the number 75% is being used (i.e. less than the equivalent tobacco tax) - but it probably should be much lower than that in order to promote vaping as an alternative to smoking.

If the taxes are fairly similar between smoking and vaping (75% is not very far from 100%), vaping is probably going to get a lot more expensive and will probably put a lot of people off it or discourage people to switch from smoking to vaping.

A much lower proportion of "sin tax" would make more sense to me

I wonder what the differential is in places like the UK for example?

It looks like it may be at 75% of the tobacco tax.

Here is the paragraph from the 2020 budget speech:

"In line with Department of Health policy, we will start taxing heated tobacco products, for example hubbly bubbly. The rate will be set at 75 per cent of the rate of cigarettes. Electronic cigarettes, or so-called vapes, will be taxed from 2021."

Its not extremely clear from the above paragraph whether the 75% is only for heated tobacco products - and that vaping will get its own level of tax in 2021 - or that vaping will also be at 75%. Nevertheless, I am assuming they mean that all these products including vaping will be at 75% of the rate on cigarettes.

I just don't know how they will calculate it - is it per ml of liquid? Per bottle? What about hardware? It really could be anything.

At least the number 75% is being used (i.e. less than the equivalent tobacco tax) - but it probably should be much lower than that in order to promote vaping as an alternative to smoking.

If the taxes are fairly similar between smoking and vaping (75% is not very far from 100%), vaping is probably going to get a lot more expensive and will probably put a lot of people off it or discourage people to switch from smoking to vaping.

A much lower proportion of "sin tax" would make more sense to me

I wonder what the differential is in places like the UK for example?

Vaping products are already taxed to the final consumer as we pay VAT on these these products. The whole additional 75% of the analog combustibles is an ADDITIONAL tax on vaping products due to vaping being classified as a 'sin' item.They regard taxing vaping as "regressive and ill-considered".

Firstly, why should vaping not be taxed? Everything else is, so give me one good reason why vaping should be excluded. (Not that I would jump for joy over tax. Not at all. I'm just thinking logically.)

Secondly, if it is taxed it won't be banned! The govt. won't cut off a source of income.

Join them in "advocating for no tax on vaping"? You've got to be kidding!

The reality is that if they have to implement a sintax on vaping products it could only make sense to tax liquid that contains nicotine as all other ingredients are in vape liquid are food grade items. By taxing hardware etc it opens up a lot of possibilities of dispute which i dont feel they will get right.

I don't know how else they can add a sintax, besides only taxing liquid containing nic.

There hasn't been an official number on how much they will tax vaping products. But one could belive it will be inline of hubbly's that if 75% of tobacco sintax. So if one goes by that a R200 bottle of juice would cost roughly around R275.

Not ideal, but it is the lesser of the evils. At least vaping would be looked at in light of regulation and not prohibition.

Not ideal, but it is the lesser of the evils. At least vaping would be looked at in light of regulation and not prohibition.

to tax liquid that contains nicotine

If this is the approach then one could sell 0mg juice to the public and they could then just add their sin-taxed nic.

If this is done the government wouldn't collect much and the supposed deterrent would be tiny.

https://www.sanews.gov.za/south-africa/sin-taxes-increase

Sin Taxes increase

Wednesday, February 26, 2020

Smokers and drinkers will from Wednesday have to dig deeper into their pockets for cigarettes and alcohol.

This comes after Finance Minister Tito Mboweni in the 2020 Budget Speech announced increases of between 4.4 and 7.5% in excise duties on alcohol and tobacco.

From Wednesday, a 340ml can of beer or cider will cost an extra 8c while a 750ml bottle of wine will cost an extra 14c.

Other increases will see a 750ml bottle of sparkling wine cost an extra 61c, while a bottle of 750ml spirits, including whisky, gin or vodka, will rise by R2.89.

A packet of 20 cigarettes will be an extra 74c, while a 25 gram of piped tobacco and a 23 gram cigar will cost an extra 40c and R6.73, respectively.

In its Budget Review report, the National Treasury said Government will introduce a new category or tariff sub-heading for heated tobacco products in the schedule of excise duties. These products are not currently subject to excise duty.

“[These are] to be taxed at a rate of 75% of the cigarette excise rate with immediate effect,” reads the report.

Electronic cigarettes are different to heated tobacco products: they do not contain tobacco, but they do contain nicotine or other chemicals.

“Currently, electronic cigarettes are not taxed,” said National Treasury.

The report notes that, globally, policymakers are looking at regulating and taxing these products due to concerns about their health effects.

Government intends to tax electronic cigarettes in 2021.

The 2020 Budget has again not spared smokers and alcohol drinkers.

Taxes on alcohol and tobacco, reads the report, are determined within a policy framework that targets the excise duty burden.

“The excise burdens for most types of alcoholic beverages and tobacco products currently exceed the targeted level as a result of above-inflation increases and price fluctuations,” reads the Budget Review.

Government will increase most excise duties by an amount that matches expected inflation of 4.4% for 2020/21, and by 6% in the case of sparkling wine and 7.5% for pipe tobacco and cigars. – SAnews.gov.za

I think they still don't know exactly how (to implement) and how much it will be.

Sin Taxes increase

Wednesday, February 26, 2020

Smokers and drinkers will from Wednesday have to dig deeper into their pockets for cigarettes and alcohol.

This comes after Finance Minister Tito Mboweni in the 2020 Budget Speech announced increases of between 4.4 and 7.5% in excise duties on alcohol and tobacco.

From Wednesday, a 340ml can of beer or cider will cost an extra 8c while a 750ml bottle of wine will cost an extra 14c.

Other increases will see a 750ml bottle of sparkling wine cost an extra 61c, while a bottle of 750ml spirits, including whisky, gin or vodka, will rise by R2.89.

A packet of 20 cigarettes will be an extra 74c, while a 25 gram of piped tobacco and a 23 gram cigar will cost an extra 40c and R6.73, respectively.

In its Budget Review report, the National Treasury said Government will introduce a new category or tariff sub-heading for heated tobacco products in the schedule of excise duties. These products are not currently subject to excise duty.

“[These are] to be taxed at a rate of 75% of the cigarette excise rate with immediate effect,” reads the report.

Electronic cigarettes are different to heated tobacco products: they do not contain tobacco, but they do contain nicotine or other chemicals.

“Currently, electronic cigarettes are not taxed,” said National Treasury.

The report notes that, globally, policymakers are looking at regulating and taxing these products due to concerns about their health effects.

Government intends to tax electronic cigarettes in 2021.

The 2020 Budget has again not spared smokers and alcohol drinkers.

Taxes on alcohol and tobacco, reads the report, are determined within a policy framework that targets the excise duty burden.

“The excise burdens for most types of alcoholic beverages and tobacco products currently exceed the targeted level as a result of above-inflation increases and price fluctuations,” reads the Budget Review.

Government will increase most excise duties by an amount that matches expected inflation of 4.4% for 2020/21, and by 6% in the case of sparkling wine and 7.5% for pipe tobacco and cigars. – SAnews.gov.za

I think they still don't know exactly how (to implement) and how much it will be.

Pretty much half of the price of an average box of cigarettes goes to Excise (sin tax from what i remember, its around R17.50 that is "sin tax").There hasn't been an official number on how much they will tax vaping products. But one could belive it will be inline of hubbly's that if 75% of tobacco sintax. So if one goes by that a R200 bottle of juice would cost roughly around R275.

Not ideal, but it is the lesser of the evils. At least vaping would be looked at in light of regulation and not prohibition.

If applying percentages (and using the Hubbly theory of 75%) - then i see the tax as follows:

"premium" local 100ml juice = R360

Excise = 75% of 50% of the value, meaning "Sin Tax" = R135.

New juice price = R495

Time will tell i guess - my calcs are linear and based on an "as-is" application. Sin tax is paid across the value chain as far i remember (manufacturer pays it and essentially recoups the cost when selling on to the distros, who then recoup by selling to retailers, etc".

There hasn't been an official number on how much they will tax vaping products. But one could belive it will be inline of hubbly's that if 75% of tobacco sintax. So if one goes by that a R200 bottle of juice would cost roughly around R275.

Not ideal, but it is the lesser of the evils. At least vaping would be looked at in light of regulation and not prohibition.

My point exactly @Adephi!

Vaping products are already taxed to the final consumer as we pay VAT on these these products. The whole additional 75% of the analog combustibles is an ADDITIONAL tax on vaping products due to vaping being classified as a 'sin' item.

The reality is that if they have to implement a sintax on vaping products it could only make sense to tax liquid that contains nicotine as all other ingredients are in vape liquid are food grade items. By taxing hardware etc it opens up a lot of possibilities of dispute which i dont feel they will get right.

I don't know how else they can add a sintax, besides only taxing liquid containing nic.

Im not so sure VAT is paid on all products vaping related - i have squizzed through a few of my invoices from stores and it doesnt seem all of them apply VAT on purchases. This may also be part of the reason for the regulation aspect - it will close other not so associated loopholes as well.

I stated this on the basis that i know a lot of wholesalers in SA and they all charge VAT on their wholesale pricong so it just makes sound business practice to pass that charge on to the final consumer.Im not so sure VAT is paid on all products vaping related - i have squizzed through a few of my invoices from stores and it doesnt seem all of them apply VAT on purchases. This may also be part of the reason for the regulation aspect - it will close other not so associated loopholes as well.

AFAIK vaping is @ the moment taxed, just as everything else. What are they proposing is additional "sin" tax and VPASA is complaining on that.

Someone in the bussiness, please correct me if I'm wrong.

I think you've hit the nail on the head @alex1501

If the 75% of Ciggie tax is applied to E-liquid, a R200 bottle of Juice would cost about R290 with the tax applied.Pretty much half of the price of an average box of cigarettes goes to Excise (sin tax from what i remember, its around R17.50 that is "sin tax").

If applying percentages (and using the Hubbly theory of 75%) - then i see the tax as follows:

"premium" local 100ml juice = R360

Excise = 75% of 50% of the value, meaning "Sin Tax" = R135.

New juice price = R495

Time will tell i guess - my calcs are linear and based on an "as-is" application. Sin tax is paid across the value chain as far i remember (manufacturer pays it and essentially recoups the cost when selling on to the distros, who then recoup by selling to retailers, etc".

If I'm not mistaken, they will tax 0mg juice as well, even though it does not have Nic in it, there are other potentially harmful chemicals in the juice. - This will be their argument

Last edited:

If the 75% of Ciggie tax is applied to E-liquid, a R200 bottle of Juice would cost about R290 with the tax applied.

If I'm not mistaken, they will tax 0mg juice as well, even though it does not have Nic in it, there are other potentially harmful chemicals in the juice. - This will be there argument

It will be awful - there's no doubt about that, but let's rather lose the battle but win the war.

Will depend on whether the store is VAT registered in the first place ... if not then they wont apply a VAT charge.Im not so sure VAT is paid on all products vaping related - i have squizzed through a few of my invoices from stores and it doesnt seem all of them apply VAT on purchases. This may also be part of the reason for the regulation aspect - it will close other not so associated loopholes as well.

It will be awful - there's no doubt about that, but let's rather lose the battle but win the war.

I find that strategy rather curious in this particular case. How it works exactly? They (government) attacks, we surrender without a fight. What's the next step? I'm missing the winning part.

Here is VPASA open letter to the Finance Minister:

https://vpasa.org.za/wp-content/uploads/2020/02/VPASA-Open-Letter-To-Minister-Tito-Mboweni-.pdf

I think VPASA deserves our full support in this case, but I could be wrong.

Are we as vapers going to dispute this tax issue or are we going to stand and watch what happens.

I am also pretty sure they have trolls watching our discussions and trying to formulate their plan towards taxing vape products by what they read here.

(Not a conspiracy theory,it's how I feel)

I see this as a similar issue as the new hardware, that had to have nicotine warnings. That was like admitting to doing something that never happened.

Anyway I will still find a loophole.

I am also pretty sure they have trolls watching our discussions and trying to formulate their plan towards taxing vape products by what they read here.

(Not a conspiracy theory,it's how I feel)

I see this as a similar issue as the new hardware, that had to have nicotine warnings. That was like admitting to doing something that never happened.

Anyway I will still find a loophole.

I find that strategy rather curious in this particular case. How it works exactly? They (government) attacks, we surrender without a fight. What's the next step? I'm missing the winning part.

Here is VPASA open letter to the Finance Minister:

https://vpasa.org.za/wp-content/uploads/2020/02/VPASA-Open-Letter-To-Minister-Tito-Mboweni-.pdf

I think VPASA deserves our full support in this case, but I could be wrong.

Where do I sign???

Where do I sign???

https://vpasa.org.za/index.php/2020/02/18/stop-excise-on-vaping/

Should be here, but I feel they could improve it a little.

Doesn't work.https://vpasa.org.za/index.php/2020/02/18/stop-excise-on-vaping/

Should be here, but I feel they could improve it a little.

The captcha is messing with me. I do it tomorrow.

Isn't 75% of R200 equal to R150 so it would cost R350?There hasn't been an official number on how much they will tax vaping products. But one could belive it will be inline of hubbly's that if 75% of tobacco sintax. So if one goes by that a R200 bottle of juice would cost roughly around R275.

Not ideal, but it is the lesser of the evils. At least vaping would be looked at in light of regulation and not prohibition.

I find that strategy rather curious in this particular case. How it works exactly? They (government) attacks, we surrender without a fight. What's the next step? I'm missing the winning part.

Here is VPASA open letter to the Finance Minister:

https://vpasa.org.za/wp-content/uploads/2020/02/VPASA-Open-Letter-To-Minister-Tito-Mboweni-.pdf

I think VPASA deserves our full support in this case, but I could be wrong.

If we look at what is happening internationally, vaping per se is under threat, with countries banning it outright or banning flavours. There is a global threat, or war, against vaping. Our govt. could easily be swayed and we don't want that, do we?

So yes, give in to sin tax without a fight. Our govt. wants money from vaping - give it to them. Don't fight that battle. By so doing, they won't ban vaping.

Rather lose the battle of sin tax and WIN the war for vaping.

Let's use home invasions as an analogy. If someone breaks into your house while you're there, you could fight them to prevent them stealing your valuables - but you will probably lose your life in the process.

Or, you could calmly say, "Take whatever you want." Perhaps you'll lose your cellphone, laptop and TV - but you'll still have your life.

Rather lose your material goods and WIN your life.

Rather lose the battle of sin tax and WIN vaping.

In Life, we have to choose our battles wisely.

Last edited:

If we look at what is happening internationally, vaping per se is under threat, with countries banning it outright or banning flavours. There is a global threat, or war, against vaping. Our govt. could easily be swayed and we don't want that, do we?

So yes, give in to sin tax without a fight. Our govt. wants money from vaping - give it to them. Don't fight that battle. By so doing, they won't ban vaping.

Rather lose the battle of sin tax and WIN the war for vaping.

I fully understand and appreciate that aproach. It's almost attractive until you start thinking about it.

First, by accepting it without a fight, we accept the position that vaping is a problem and not a solution. And personally, I strongly disagree with that.

Many people already find vaping too expensive, double that price and half of them go back to smoking.

The vaping market is already small and fragile in SA, if it starts shrinking istead of growing, shops loose the turnover, they'll start first reducing (range and quantity of) the stock, then start closing down...

...Long story short:

In the end we are back in Pick and Pay in line for "Twisp Cue"(or similar), and I can't see that as a victory (for anyone, except maybe, for the last standing company).

Disclaimer:

I don't work for any vaping company.

This is only my personal opinion.

The use of "Twisp" name is only coincidental.

Similar threads

- Replies

- 2

- Views

- 2K

- Replies

- 1

- Views

- 2K

- Replies

- 0

- Views

- 10K