Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Vape tax from 1 June 2023 !

- Thread starter Mr. B

- Start date

Guess I'll stock up on juices I like. When thats finished, so will my vaping be finished. (Either that or someone, somewhere finds a loophole and starts selling untaxed "illicit" juice. I'll support that if it's still the same juice)

I'm not paying R600+ for a bottle of juice. Government can go F itself!

I'm not paying R600+ for a bottle of juice. Government can go F itself!

V

Viper_SA

Guest

So... Let me see if I have this correct. PG and VG are exempt. So diy is still an option. Then you'd be taxed on your pure nic only? How will this impact flavorings and one-shots?

They mean R2.90 per ml of 0mg juice also, psychotic bunchBy nicotine, do they mean 36mg, 100mg, or pure concentration?

If pure, then there is almost no tax on nic at all.

DIY flavourings are also exempt. Vaping makes up about 5% of total use (if as much) of these flavourings in the general market. Same goes for PG/VG. Used in many other markets, but mostly food manufacture.So... Let me see if I have this correct. PG and VG are exempt. So diy is still an option. Then you'd be taxed on your pure nic only? How will this impact flavorings and one-shots?

Per ml, irrespective of concentration. But no-one sells 1000mg pure nic to DIY'ers as it would be madness, that stuff is lethal.By nicotine, do they mean 36mg, 100mg, or pure concentration?

If pure, then there is almost no tax on nic at all.

V

Viper_SA

Guest

I can't afford to stock up right now, so my route would be getting back into DIY and hoping for one-shots and that they won't be taxed. I can live with buying 100mg nic taxed, with all the rest untaxed, but I know it would not taste the same and a lot of manufacturers are going to suffer because of this.

DIY flavourings are also exempt. Vaping makes up about 5% of total use (if as much) of these flavourings in the general market. Same goes for PG/VG. Used in many other markets, but mostly food manufacture.

Per ml, irrespective of concentration. But no-one sells 1000mg pure nic to DIY'ers as it would be madness, that stuff is lethal.

I meant there's only roughly 5ml of pure nic in 50ml of 100mg nic so tax would be for that 5ml since we are only taxing purely the nic part. Rest pg/vg.

It's rather weird that in the actual amended act, the phrase "nicotine substitute" is used. Technically there's no such thing? There is tobacco substitute, cig substitute etc?

They are going to have to publish more amendments to clarify everything. Either that or there will be a few court cases on it.

Last edited:

Most recently, they amended the act to say 'containing nicotine' and 'containing nicotine substitute' (very cringe English). So, some are assuming that 0mg juice is not a 'nicotine substitute' whatever that means.They mean R2.90 per ml of 0mg juice also, psychotic bunch

Not funny, I just had to laugh. We need to call a nationwide strike and burn some tiresSlick just put this on their Facebook pageabsolutely non affordable

I know we don't speak much politics on the forum, and thats a good thing.Not funny, I just had to laugh. We need to call a nationwide strike and burn some tires

But I have not heard a single party mention anything about opposing this vape bill. If there was please point me in that direction. It could be an easy 20k-30k votes for next year.

Last edited:

Maybe we as Vapers and Ecigssa member should try and counter this or at least see where we need to start, because I see the blackmarket booming coming June 2023I know we don't speak much politics on the forum, and thats a good thing.

But I have not heard a single party mention anything about opposing this vape bill. If there was please point me in that direction. It could an easy 20k-30k votes for next year.

Still their intentions for tax are based on vape products, alternatives to smoking. E-liquid with and without nicotine is mentioned I didn't see any others like the iquos etc.Most recently, they amended the act to say 'containing nicotine' and 'containing nicotine substitute' (very cringe English). So, some are assuming that 0mg juice is not a 'nicotine substitute' whatever that means.

I've been vaping flavour free for a while, yet I still need to get VG and nicotine. I'm getting a bit worried about this thing.

Allow me to chime in here. It's late, my brain is rusty, so I may be wrong. If so can someone please educate me.

The way I see the legislation it is aimed at import and manufacture of Vape juice, containing nicotine or not.. Typically, that is how excise duty works.

So the R2.90 is on vape juice containing nicotine or not.

Not on it's component parts. In my reading nicotine per se does not fall under this bill. It does not cover pg/vg or nicotine in isolation. There is no wording that says nicotine falls under it? If there is please point me to where it is. Remember, vape juice.

The way I see the legislation it is aimed at import and manufacture of Vape juice, containing nicotine or not.. Typically, that is how excise duty works.

So the R2.90 is on vape juice containing nicotine or not.

Not on it's component parts. In my reading nicotine per se does not fall under this bill. It does not cover pg/vg or nicotine in isolation. There is no wording that says nicotine falls under it? If there is please point me to where it is. Remember, vape juice.

My understanding is the same.Allow me to chime in here. It's late, my brain is rusty, so I may be wrong. If so can someone please educate me.

The way I see the legislation it is aimed at import and manufacture of Vape juice, containing nicotine or not.. Typically, that is how excise duty works.

So the R2.90 is on vape juice containing nicotine or not.

Not on it's component parts. In my reading nicotine per se does not fall under this bill. It does not cover pg/vg or nicotine in isolation. There is no wording that says nicotine falls under it? If there is please point me to where it is. Remember, vape juice.

It's a tax per ml irrespective of nicotine content.

So a disposable carrying 5ml of 5% salt juice will go up by R15 or so.

Kinda defeats the purpose of harm reduction and breaking dependence on nic as well, as the market uptake will likely shift more towards high nic and disposables as a result.

And then we have the UK who are zipping the opposite way and giving a million people free vape kits to convert them away from analogues.

To paraphrase Trevor Noah - 'Satafrika. The world goes one way and we go the other'.

Allow me to chime in here. It's late, my brain is rusty, so I may be wrong. If so can someone please educate me.

The way I see the legislation it is aimed at import and manufacture of Vape juice, containing nicotine or not.. Typically, that is how excise duty works.

So the R2.90 is on vape juice containing nicotine or not.

Not on it's component parts. In my reading nicotine per se does not fall under this bill. It does not cover pg/vg or nicotine in isolation. There is no wording that says nicotine falls under it? If there is please point me to where it is. Remember, vape juice.

I see your reasoning,but nowhere doesn't it say any different. In a country where corruption is the order of the day... Nicotine content is still nicotine content doesn't matter the container.My understanding is the same.

It's a tax per ml irrespective of nicotine content.

So a disposable carrying 5ml of 5% salt juice will go up by R15 or so.

Kinda defeats the purpose of harm reduction and breaking dependence on nic as well, as the market uptake will likely shift more towards high nic and disposables as a result.

And then we have the UK who are zipping the opposite way and giving a million people free vape kits to convert them away from analogues.

To paraphrase Trevor Noah - 'Satafrika. The world goes one way and we go the other'.

"

Check the proposal... It says" nicotine and non nicotine solutions"

So Im all for giving them the benefit of the doubt, but all that been happening eversince I can remember is when the doubt becomes real, there is no benefit.

Remember nicotine is also still part of the import /export trade.

I might be wrong in everything I said so if I am I'm apologizing now already.

I was thinking this very same thing...who comes up with this stuff..a bunch of people that has no level of education...this entire thing has been purely thought out...one even wonders if this is really happening because hoe does a half ass law get passed like this...only is SA....can we not maybe burn burn stuff...goverment listens to that normally...I'm ready when you guys are...I have box of matchesOne of my big gripes is this. They want to get kids to stop vaping, right? What do kids vape? 120ml/100ml/60ml bottle juices? NO. They vape disposables. What will the tax be on a disposable. R6, R9, maybe R12. That's not going to stop them. So who gets punished by this? Adults like me.

Agree...a 1st world country we should learn by. UK launching thier swop to stop programMy understanding is the same.

It's a tax per ml irrespective of nicotine content.

So a disposable carrying 5ml of 5% salt juice will go up by R15 or so.

Kinda defeats the purpose of harm reduction and breaking dependence on nic as well, as the market uptake will likely shift more towards high nic and disposables as a result.

And then we have the UK who are zipping the opposite way and giving a million people free vape kits to convert them away from analogues.

To paraphrase Trevor Noah - 'Satafrika. The world goes one way and we go the other'.

I know we don't speak much politics on the forum, and thats a good thing.

But I have not heard a single party mention anything about opposing this vape bill. If there was please point me in that direction. It could be an easy 20k-30k votes for next year.

@Adephi A link to a petition was posted here https://www.ecigssa.co.za/threads/vsml-petition.76873/

Dude let's hope someone else suggests burning something otherwise us capetonians will look like a violent bunchI was thinking this very same thing...who comes up with this stuff..a bunch of people that has no level of education...this entire thing has been purely thought out...one even wonders if this is really happening because hoe does a half ass law get passed like this...only is SA....can we not maybe burn burn stuff...goverment listens to that normally...I'm ready when you guys are...I have box of matches

Lets suggest burning something on a "braai" instead

That was the proposal. The final amendment was different.I see your reasoning,but nowhere doesn't it say any different. In a country where corruption is the order of the day... Nicotine content is still nicotine content doesn't matter the container.

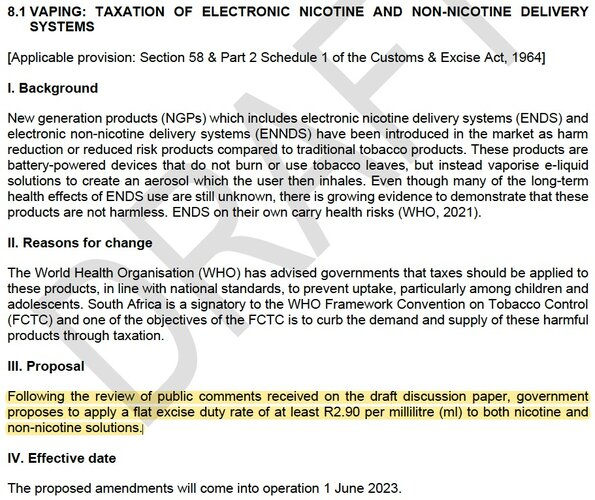

"View attachment 271825

Check the proposal... It says" nicotine and non nicotine solutions"

So Im all for giving them the benefit of the doubt, but all that been happening eversince I can remember is when the doubt becomes real, there is no benefit.

Remember nicotine is also still part of the import /export trade.

I might be wrong in everything I said so if I am I'm apologizing now already.

Ultimately because every single MP is some party's cadre and not beholden to the people of their respective constituencies.I was thinking this very same thing...who comes up with this stuff..a bunch of people that has no level of education...this entire thing has been purely thought out...one even wonders if this is really happening because hoe does a half ass law get passed like this...only is SA....can we not maybe burn burn stuff...goverment listens to that normally...I'm ready when you guys are...I have box of matches

Dlamini-Zuma's spies are watching!!!!I know we don't speak much politics on the forum, and thats a good thing.

But I have not heard a single party mention anything about opposing this vape bill. If there was please point me in that direction. It could be an easy 20k-30k votes for next year.

Similar threads

- Replies

- 0

- Views

- 1K

- Replies

- 1

- Views

- 2K

- Replies

- 0

- Views

- 500